Industry News

Kenya’s construction growth slows to six-year low of 6.4%

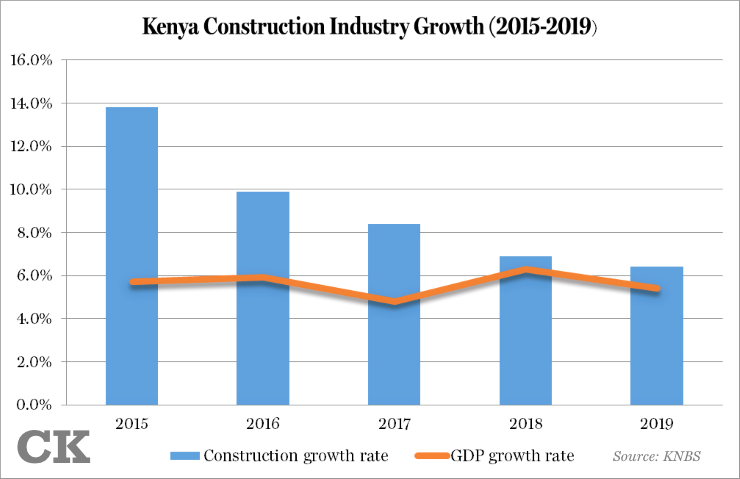

The sector grew by 6.4pc in 2019, down from 6.9pc in 2018.

Construction industry growth in Kenya slowed last year to its lowest rate in six years, largely weakened by a loss of momentum in public infrastructure projects, official figures show.

The Economic Survey 2020, release on Tuesday by the Kenya National Bureau of Statistics, revealed that the construction sector expanded by 6.4 per cent in 2019 down from 6.9 per cent in 2018 – the lowest rate since 2013’s 5.8 per cent expansion.

The marginal slowdown coincided with the winding down of construction works for the 120km Nairobi-Naivasha standard gauge railway, which was completed in the third quarter.

“The construction of Phase 2A section 1 of the Standard Gauge Railway (SGR) from Nairobi to Naivasha covering a rail distance of 120 kilometres was completed in September 2019 at a cost of Sh150 billion,” KNBS director-general Zachary Mwangi said in the survey.

READ: State reveals funding talks for Naivasha-Kisumu railway

The standard gauge railway project has been a major driver of construction growth in Kenya. In deed the industry has been on a steady decline since 2016 when the first phase of construction of the single-track SGR from Mombasa to Nairobi was completed.

Besides completion of the Nairobi-Naivasha railway, the Kenyan construction industry growth was also undermined by the suspension of about 500 mega projects across the country due to a cocktail of issues including court battles and lack of funds.

The stalled projects require about Sh1 trillion to complete.

“The number of stalled projects is increasing, and is currently estimated at approximately 500, because of non-payment to contractors, insufficient allocation of funds to projects, and litigation cases in court,” the IMF said in a report released in January.

In 2019, cement consumption declined 0.3 per cent to 5.93 million tonnes from 5.94 million tonnes in 2018. On the other hand, cement production fell 1.0 per cent to 5.97 million tonnes from 6.06 million tonnes in 2018.

Loans and advances from commercial banks to the construction industry rose 1.6 per cent to Sh115.8 billion from Sh114.0 billion in 2018. The industry’s total wage employment grew by 1.5 per cent to about 221,600 persons up from 218,300 persons in 2018.

The Economic Survey 2020 suggests that construction of private residential and non-residential buildings across the country helped to keep the sector afloat during the year.

“The index of reported private building works completed in Nairobi City County increased by 3.5 per cent from 466.2 points in 2018 to 482.3 points in 2019,” the report says.

The total number of completed private residential and non-residential buildings in Nairobi rose 9.8 per cent to 13,976 houses in 2019, up from 12,725 houses in 2018. This happened in spite of a spike in the cost of building materials as well as rising labour costs.

The cost of materials for residential buildings rose by 6.5 per cent last year compared to 3.3 per cent in 2018, while labour costs for the segment rose 4.5 per cent in 2019 after a 5.3 per cent increase in 2018.

A tough second quarter beckons the construction industry if the Covid-19 related disruptions continue to slow down operations on building sites across the country as builders adopt social distancing measures.

However, industry insiders expect a quick recovery after restrictions to stop the spread of the virus start to be relaxed this month.

“We see it recovers fast. We have seen that in China, we also see that in Switzerland and Germany. We see it (the market) being very resilient in the U.S.” LafargeHolcim CEO Jan Jenisch said on Thursday.

The Swiss company, which has a controlling interest in Bamburi Cement, has reported a drop in sales and profit during its first quarter as Covid-19 closed building sites around the world.

But with China, the first country affected by the Coronavirus outbreak, already back to full production, LafargeHolcim expects cement volumes during Q2 to be close to 2019 heights.