Industry News

Construction Growth Rate Hits 5-year High on Mega Projects

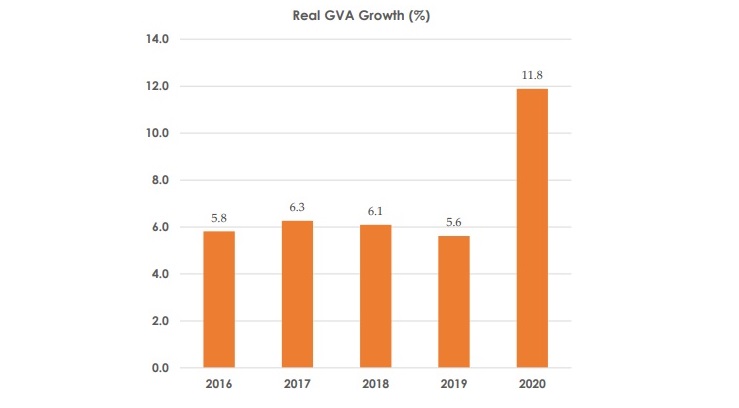

The industry grew 11.8% last year compared with 5.6% in 2019.

The Kenyan construction industry defied the COVID-19 economic fallout in 2020 to record its fastest growth in five years, according to a closely watched survey released on Thursday.

The Economic Survey 2021 shows that the industry, which comprises buildings, roads and railway, grew 11.8% in 2020 compared with 5.6% in 2019, driven by mega road projects.

“The accelerated growth was attributed to the continued investments in road infrastructure by the government and expanded construction in the housing sub-sector,” the Kenya National Bureau of Statistics (KNBS) said in the Economic Survey 2021.

The growth, which was also supported by rehabilitation of metre gauge railways in parts of the country, is in stark contrast to that of the general economy, which contracted to -0.3% compared to 5.0% in 2019 due to disruptions caused by the COVID-19 pandemic.

During the period under review, consumption of cement – which is a key input in the sector – rose 21.3% from 6.1 million tonnes in 2019 to 7.4 million tonnes in 2020.

Loans and advances from commercial banks to the construction industry rose 3.4% to Sh119.7 billion last year up from Sh115.8 billion in 2019.

Completed residential buildings

The number of completed public residential buildings built by the State Department for Housing and the National Housing Corporation stood at 2,332 and 338, respectively in 2020.

“The value of public buildings completed increased substantially to Sh9,084.3 million in 2020, compared to Sh1,509.1 million in 2019,” says the Economic Survey 2021.

Importation of timber and wood products, bitumen and cement, and construction related materials, grew by 69.6%, 15.2% and 3.4%, respectively.

Last month, the KNBS said the local cement market saw a demand increase of 26.6% in the first five months of 2021, driven by public infrastructure and home construction projects.

According to the statistics agency, cement consumption stood at 3.35 million tonnes in the January to May window compared to 2.64 million tonnes last year.

RELATED: Kenya’s Cement Demand Rises 27% on State Projects

During the period, production rose 27.3% to 3.38 million tonnes, from 2.65 million tonnes in the similar period of 2020 as producers raced to meet the rising demand.

This growth has been attributed to projects such as the Nairobi Expressway, Dongo Kundu Bypass, James Gichuru-Rironi highway, Nairobi Western Bypass, and the ongoing construction of mega dams in parts of the country.

Private developers and individual households, who have been building even during the toughest months of the pandemic, have also boosted the market.