Executives

How I Turned My Side Hustle Into a Thriving Company

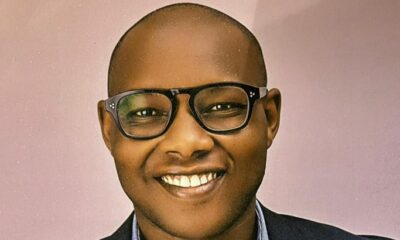

Reuben Kimani quit Safaricom PLC to start a real estate company.

Reuben Kimani considers himself a man of faith, a Christian, and a firm believer that anyone can achieve whatever they set their mind – and work hard – to.

This is an accurate self-assessment of a man who took his own leap of faith and resigned from a six-figure job at Safaricom PLC to focus on a side hustle that would later become one of Kenya’s leading real estate companies.

Born in Nyandarua County in the 1980s, Kimani attended two primary schools in Nyandarua and Laikipia before joining Ndururumo High School in Laikipia County.

He then proceeded to the Jomo Kenyatta University of Agriculture and Technology (JKUAT) to pursue a Bachelor’s Degree in Computer Technology.

Upon graduating with a First Class Honours, Mr Kimani undertook some jobs “here and there” before joining Safaricom as a Graduate Management Engineer in 2010.

He was later promoted to Systems Engineer, a position he held for five years.

Throughout this period, Mr Kimani was quietly working on a side hustle that would later become a multi-million-shilling real estate company Username.

“[Our history] can be traced back to 2013 when we started operations as three directors. Bundled with a lot of passion and interest in real estate, we first started the company as a side hustle,” Mr Kimani said in an interview.

Resignation

The CEO and two other directors of Username: Joseph Gitonga and Julius Karanja, were all employed at the time of founding the company. In 2015 Kimani quit Safaricom to focus on the side hustle, and the two others followed him in 2017.

In the new arrangement, Mr Kimani became the CEO of Username Investment Ltd., while Gitonga and Karanja became Head of Sales and Marketing and Head of Finance and Customer Relations respectively.

By that time, Username – which was started with an initial capital of Sh2.5 million that was used to acquire 42 acres in Konza, was already undertaking several small projects with a bigger vision of scaling up operations.

Affordable properties

“At the outset we realized that there was a huge gap in the [real estate] sector. In particular, there was lack of affordable properties. Most young people were willing to buy properties but they could not afford.

“Statistics indicate that over 50% of our population is under the age of 25. We wanted to invest in this generation so that we could empower their future. If you realize most of our projects are under half a million shillings, Mr Kimani said.

This strategy paid off – helping the company to create a customer database of over 10,000 clients in more than 55 projects located in Konza, Ngong, Nakuru, Machakos, Naivasha, Kangundo Road, Matuu, and other urban areas.

“We have directly employed 65 young people and over 500 indirectly. This includes our lawyers, surveyors, contractors, suppliers and many others. I am proud that despite the global Covid-19 pandemic that hit the world and the economy, we did not downsize rather we created more opportunities,” he said.

Sh650 million

According to Mr Kimani, Username Investment has in less than a decade grown from a turnover of Sh25 million to Sh650 million, thus becoming one of the leading real estate companies in Kenya.

“We now have 3 offices; 2 in Nairobi and 1 in Nakuru and with presence in USA. We have also been able to provide Kenyans living in diaspora with affordable investment opportunities and delivered title deeds,” adds Mr Kimani.

Challenges

According to the CEO, the Kenyan real estate sector is full of challenges the biggest of them being fraud. Indeed, Username has been a victim of this menace.

“We were conned out of Sh5 million in 2016 but we were lucky to recover the money,” he says without going into lengthy details.

READ: How to Spot and Avoid the Snares of Real Estate Conmen

Raising capital is also a challenge for most people as banks often hesitate to lend cash to newbies as a way of cushioning themselves from the rising cases of fraud.

For Mr Kimani, age has also been a major challenge.

“We are young guys and huge properties are mostly owned by elderly people. Most of them rule us out until we tag along our middle-aged lawyer or we pay upfront after the agreement. That is when they can trust us,” he says.

“There is also a time we bought land and paid a deposit for it after the agreement. We then started selling it and the owner then doubled the price even before we concluded the buyout.

“There is no way we could have stopped the project because we did not want to compromise our name. So, we bought it at twice the price, ate a humble pie but with some good lessons to boot. It was a loss,” Mr Kimani adds.

To overcome these challenges, the CEO says that Username Investment Limited now does a lot of due diligence before proceeding to buy any property.